State Bank of India has approved The Institute of Entrepreneurship Development (IED) as a Business Correspondent to provide comprehensive financial services to the underprivileged encompassing savings, credit, remittance, insurance, Mutual Funds and pension products in a cost effective manner, particularly in untapped / unbanked areas. The Institute of Entrepreneurship Development (IED) is providing the BC services in both Tamilnadu and Pudhucherry since 2015.

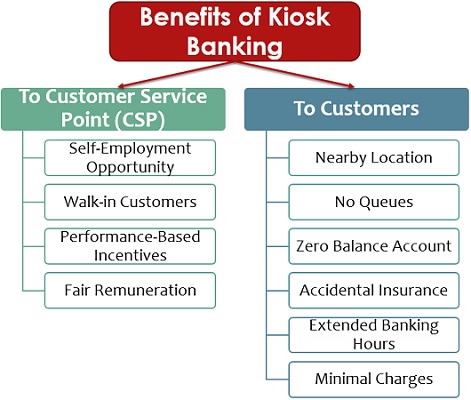

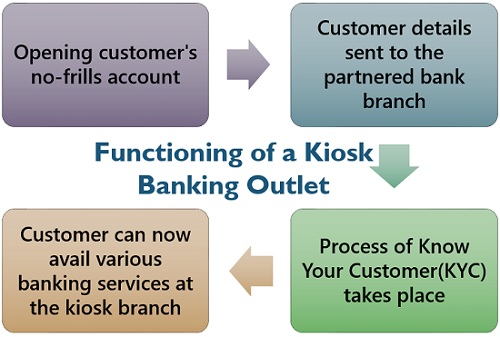

The BC arrangement essentially means enrolling customers and enabling the transactions of the customers at the Customer Service Points (CSPs) besides sourcing various deposit and loan products for the Bank as a Business Facilitator. The outlets of the BCs is undertaking the BC activity through KIOSK BANKING adopted by the Bank.

The Institute of Entrepreneurship Development (IED) have 675 no.s of CSPs (Customer Service Points) both in Tamilnadu and Pudhucherry states.

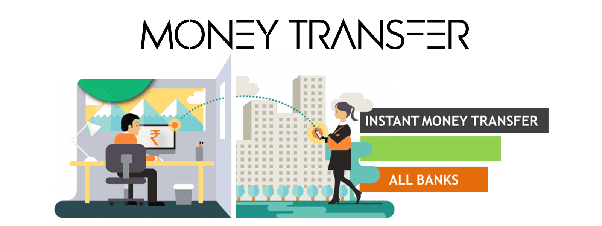

It is a banking outlet run through outsourced agency for carrying out limited transactions and sourcing of business. Jandhan Accounts, tiny RD accounts, Atal Pension Yojana, Pradhan Mantri Insurance Schemes are opened here. Customers can also withdraw and deposit money at CSPs. There are around 30 types of transactions/business are carried out by CSPs.

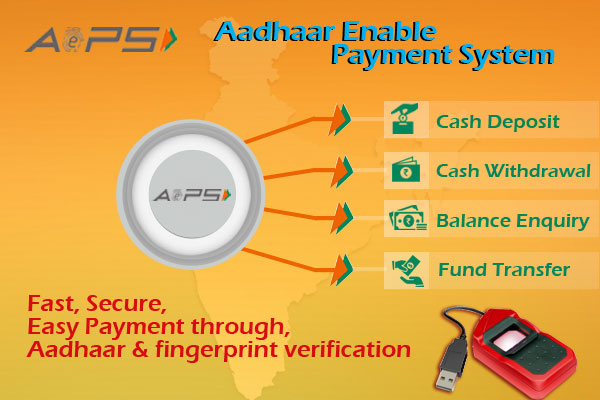

SBI Kiosk transactions are bio-metrically secured. Printed acknowledgment for each transaction is issued to the customer and has end-to-end process of account opening & online transactions.

CSPs are those individuals who acts as an agent of the bank at places where it is not possible to open branch of the bank. The Kiosk Banking Business Correspondent (BC) model aims to provide real time, user friendly financial services to the consumers in their neighbourhood.

Through the Kiosk Banking Solution the following services are being offered: